MAKE YOUR WILL TO MAKE YOUR WILL

- Mon Jan 27 18:30:00 UTC 2025

- In mentoring and guidance by Aparna Bose

WHY END-OF-LIFE PLANNING IS CRUCIAL AND HOW TO DO IT

In a quaint town called Phulera, Hariprasad and Kamala were celebrated not just for their wealth, but for their steadfast dedication to philanthropy. Although they had no children of their own, they found fulfilment in supporting their community and championing the causes they held dear. After Hariprasad meticulously drafted his will, which mentioned his wife as the legal heir and appointed his two nephews, Karan and Arjun, as executors, he felt confident that his legacy would make a meaningful impact.

As it happened, the wife also passed away soon after. Just weeks before her own death, she confided in her nephews, expressing her deep satisfaction at the thought of their wealth supporting the local shelter, the educational reform initiative, and the animal rescue—causes that had been close to their hearts. Within a span of few days Karan received an unexpected call from an old friend, conveying a distressing news: 21 legal heirs had surfaced, each claiming a stake in the couple's wealth. They ranged from distant cousins who had long been estranged to individuals who had been touched by the couple’s generosity over the years.

What went wrong here? The will was written by the husband, indicating that his wife would inherit everything if she survived him, and that the property would be given away in charity if she did not, after his lifetime. When the will was read to the family, the heirs pointed out that she had inherited the wealth from him as per the will, but that there was no will written by her in which she indicated giving away the wealth to charity. His will had specified charity only if she predeceased him.

The lawyers were in agreement with this interpretation. The will included prime property worth several crores and the so called heirs, even if many were not on talking terms with the couple when they were alive, were unwilling to let go. Getting good quality legal help in these matters remains a challenge. A longtime lawyer friend had apparently told Kamala that she should “will” him the properties and that he would settle all dues and donate the money. However, the lady had chosen to spurn the offer.

Caught between the legalities and the sheer goodwill of the deceased , one of the executers proposed an idea to the heirs: rather than fighting over the wealth, they could unite and contribute to the causes the couple loved most. This resonated deeply with many of the heirs, who saw the chance not to claim a portion but to keep the noble spirits alive.

Thus, the executers organized an event with the support of a close family friend to celebrate the couple’s life, inviting all the heirs to contribute, not to divide, the legacy of the departed.

What if the proposal of the executor did not resonate? You know. The wish would have remained unfulfilled. But a “WILL” would have been honoured. A well-drafted will is always honoured. No two ways about it.

Furthermore, the case study we have presented is unique. However, as a reputed MFD managing a commendable number of portfolios, we continually encourage our valued clients to draft their wills. When wishes are properly documented, it irons out the creases and streamlines the process of "transmission" and the legalities involved therein for the beneficiaries (claimants) or other holders of the relevant mutual fund account.

IMPORTANCE OF WILL

Your wishes are worthy of respect and should be honoured. Creating a will provides your loved ones with clear guidance, allowing them to navigate your legacy with clarity and understanding.

A will or a testament is a valid legal document that outlines the distribution of the assets of an individual to various recipients in granular detail. You can will the assets to your spouse, children, relatives or any charitable trust.

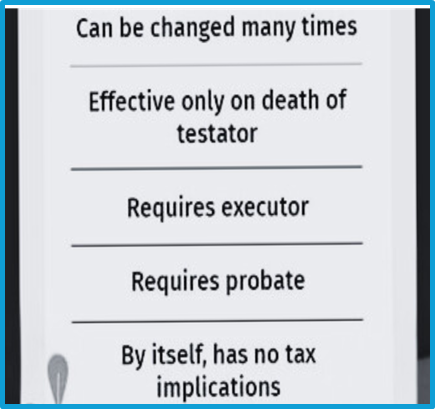

Some key points :

The normal practice is to appoint an executor for the will, who is responsible to ensure that the instructions in the will are implemented in letter and spirit. A will can be changed by the testator (when alive) any number of times. A will is effective only on the death of the testator.

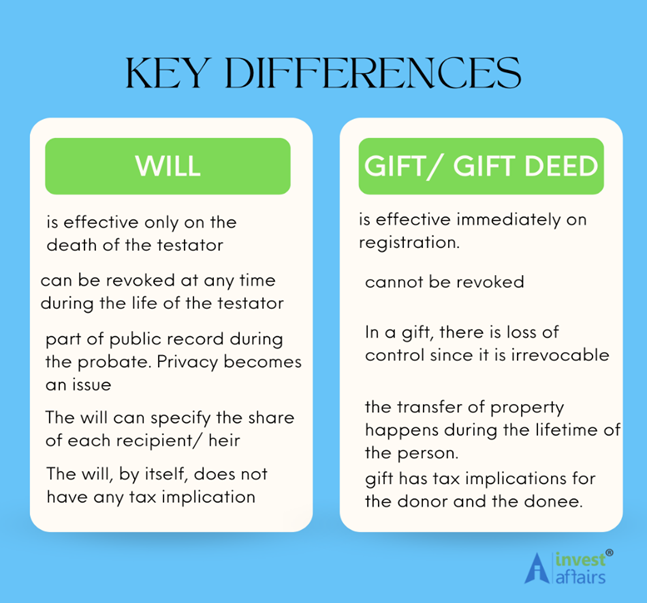

HOW DOES A WILL DIFFER FROM A GIFT DEED?

A will outlines asset distribution after the testator's death, while a gift deed transfers property ownership during the donor's lifetime. A gift deed is a legal document enabling property owners to give their property to another person as a gift, requiring no payment (consideration) from the recipient (donee).

Often used for gifting real estate, cash or other valuable assets, it differs from other property transfers as the transfer of ownership is done without the exchange of money.

However, one thing to remember here is that a “will” becomes effective only on the death of the testator whereas a “gift deed” is effective immediately on registration.

Here are some key parameters to differentiate a gift deed from a will.

IMPORTANT:

- Any gift from relatives are non-taxable. Also, any gift from person (s) other than relatives (e.g. friends ) is tax free up to the limit of Rs 50,000. Such gift can be in cash or in kind.

- Gift received from Relative is non-taxable. Thus, such amount need not be shown in your ITR.

Relative could be spouse, brother and sister of self and spouse, brother or sister of parents or parents-in-law, any lineal ascendant or descendant of self or spouse, spouse of any of the relatives

Having said that, the decision between a ‘will’ and a ‘gift’ is a personal one that should be made only after obtaining legal counsel and people must evaluate wills and gift deeds when they are still fit and healthy.

Disclaimer: The data and information has been sourced from various domains available to the public. We have taken utmost care to represent the same as factually as has been made available. Please do not make any decisions based on our blogpost. Kindly check the data & information independently. For further guidance on finance and investment please reach out to our experts at Investaffairs.

If you have any Personal Finance query, do write to us

Categories

Recent Posts